Contents

Stocks are listed on a specific exchange, which brings buyers and sellers together and acts as a market for the shares of those stocks. The exchange tracks the supply and demand — and directly related, the price — of each stock. Once shares are purchased on the primary market, investors may then trade them again on the secondary market . Once shares hit the stock market, investors are free to buy and sell stocks amongst each other. It is worth noting, however, that this is just the beginning; the real magic takes place when prices are set. In addition to serving as a place where securities are traded, stock exchanges also award participating investors with an inherent sense of security.

- Index or diverse funds are typically seen as the safest way to invest.

- The main draw of money market accounts is the chance to earn significant interest over time.

- Brokers facilitate the risk transfer process between policyholders and underwriters.

- Stocks, or equities, are securities that represent an ownership share in a public company (also known as a publicly-traded company).

- Fee-only financial advisors charge annually and provide advice on selecting investments, or make the trades for you.

If you hear that an index has dropped, that means the average value of all the stocks within that index is down from the previous trading day. In Canada, we have the S&P/TSX Composite Index, which tracks the largest companies by market capitalization on the TSX. If any investor could accurately predict market volatility, they would be wildly successful. The possibility of accurately predicting the future is nil as market volatility is a very complex subject.

What Is The Stock Market?

If there’s a low demand with many sellers, it will drive the price down. Stocks, or equities, are securities that represent an ownership share in a public company (also known as a publicly-traded company). Now, just because you’re armed with a brokerage account and a list of wonderful companies, doesn’t mean it’s time to invest. As I mentioned above, the best way to invest is to do so on your own. Most professional investors (we’re talking 96%) don’t beat the market. Over the long run, investing in the stock market produces the best returns of any investment.

Those who embrace those basic steps often enjoy an enriching experience as they benefit from the stock market’s ability to produce high returns that compound over time. The stock market or the stock exchange is a place where you can buy stocks, commodities, and bonds. It does not hold any shares of its own, instead acts as a platform where investors can buy stocks from the stock sellers. Think of it like a telephone exchange equivalent – instead of connecting a caller and a receiver, it connects buyers and sellers. The stock market is made up of exchanges, such as the New York Stock Exchange and the Nasdaq.

Overexposure to the stock market

This all may sound complicated, but computer algorithms generally do most price-setting calculations. The ‘Stock Market’ is probably one of the most commonly thrown around terms when discussing investments. This shouldn’t be surprising, since the stock market tends to give very competitive returns when compared to other investments, a fact proven over the years by statistics. Plus, no one can deny the fact that the stock market is one of the most important factors in a country’s economy.

And most https://bigbostrade.com/ would be well-advised to build a diversified portfolio of stocks or stock index funds and hold onto it through good times and bad. The process begins when a company decides to make its initial public offering. The stock market is only as complicated as investors want to make it.

You can get by just fine without understanding the stock market much at all. All trading uses real-time bid/ask prices, giving your students the same experience as Wall Street traders. Best of all, the Class Rankings update constantly throughout the day – adding an element of competition to keep your students engaged all semester long. Find out how Andy Tanner uses the stock market to generate cash flow with safe, steady investing strategies – no matter what is happening in the overall economy.

As long as you keep accessing the site from the same device you won’t have to worry about changing it more than once if you only have 1 contest. Whether you’re a student, teacher or just someone looking to learn and practice, everyone starts by registering a new account. If someone has sent you an invitation link to join their contest, the link will take you straight to the registration page. If not, then all you have to do is click “CREATE ACCOUNT” from the main menu on our homepage.

By accessing the How The Market Works site, you agree not to redistribute the information found within and you agree to the Privacy Policy and Terms & Conditions. If a lot of people want to own part of a certain company, then that company’s stock price rises. From retirement savings to college savings, from short-term goals to long, there really is an investment account for everything. The key to increasing your chances of success in the stock market is to play the long game. Naturally, it makes sense that the earlier you start investing, the more your money could grow.

What is a primary stock market?

Investors who buy and sell stocks hope to turn a profit through this movement in stock prices. The stock market is where investors connect to buy and sell investments — most commonly, stocks, which are shares of ownership in a public company. A stock market is one of the most important parts of a free-market economy. It is the place where a company can offer you a slice of its ownership in exchange for capital you invest in its stocks. You can purchase stocks of those companies that are listed on the stock exchange. Bonds represent financing for long-term projects and innovations.

Chances are you’ll have seen loads of TikToks and https://forex-world.net/ ads promoting forex trading as a way to make money quickly. But the truth is that very few people involved in this corner of the market make a profit. If you’re investing in funds, dividends will be reinvested on your behalf. Pinpointing the best times to buy and sell is a skill that takes time to acquire. You shouldn’t expect to make a fortune on the markets – at least not straight away, anyway.

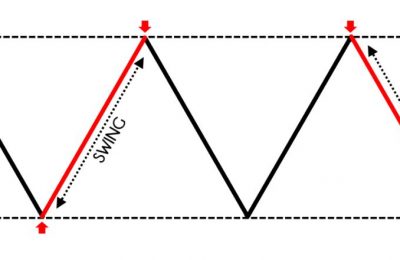

Over the course of centuries, the NYSE has established itself as a trusted marketplace for people to buy and sell stock. When stock market prices fluctuate very sharply, this is known as stock market volatility. A more than 20% gain in a stock market index from a recent bear market is a bull market. Bull markets are often multi-year events driven by a period of economic expansion. The difference between long-term investing and stock trading.

Initially, they may have relied on other https://forexarticles.net/ resources to back a loan for operating capital. Issuing company stock is a faster way of raising the money they need for their growing businesses. Individuals who want to purchase and trade stock with little assistance can do this online. They must have a brokerage account which becomes the middle vehicle to execute the trades.

For example, if you invested $10,000 at the rate of 8% annual return, after 10 years, you would have $21,590. And if you decided to contribute an additional $1,200 each year for that time frame, you would have $40,364. Of course, the more you contribute each year, the more you can earn on your investment. Both the crashes and the record-breaking highs that have occurred throughout the stock market’s history have taught us lessons. Investing in the stock market is an effective way to build wealth if you do it right. I’m sure you’ve heard of the extreme rises and dips of the stock market.

This process is called price discovery, and it’s fundamental to how the market works. Price discovery plays an important role in determining how new information affects the value of a company. One way is through capital gains, which you make when you sell a stock for more than you paid for it. The other principal way investors make money with stocks is through dividends. When a company issues a dividend, it pays shareholders a portion of the profits. Inflation and stock market volatility related to war, supply-chain issues, and rising interest rates can unsettle even the most experienced investors.

Individual and institutional investors come together on stock exchanges to buy and sell shares in a public market. When you buy a share of stock on the stock market, you are not buying it from the company, you are buying it from an existing shareholder. Prices tend to fluctuate — wildly at times — which is why investors should take a long-term approach and own a diversified portfolio of stocks.

You’ll need a demat account to store the securities you buy. You’ll also need a trading account before you can trade in the Indian stock market. Aside from differing interest rates and term lengths, bonds come from different issuers. Here’s a look at the most common bonds, from different corners of the greater bond market. Bonds are a form of debt security—meaning they represent a debt owed to the holder.

Fact is, no one truly knows where the market will go in the future. Indices not only have unique baskets of stocks, they are weighted and calculated differently. Occasionally, an index will be rebalanced so that certain stock don’t have too much influence on outcomes.

How a Company Sells Shares on the Stock Market 👷♂️

Bulletin boards that are over-the-counter are around as well. These exchanges are not as closely regulated as other more stable stock exchanges. For example, larger more reputable stock exchanges such as NYSE and others, ensure that a company meets certain requirements before it can be listed on its stock exchange. Many of them are connected electronically which enhances the efficiency of the trading system. Although it’s not mandatory, a public company can pay dividends to shareholders who purchase preferred shares.

Preferred Stock ✔️

Read our editorial process to learn more about how we fact-check and keep our content accurate, reliable, and trustworthy. A full-service broker will cost more but could be worth the price. They will give you professional recommendations based on your goals, risk profile, and budget. Investors can measure stock with two different types of market indexes. The stock’s value is thought to be higher than its price on the market.