For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. In the realm of subscription-based services, the phenomenon of churn represents a critical metric… 3 ways to maximize itemized tax deductions In such an instance, the costs must be directly attributed to the manufacture and assembly of the electronic device. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications.

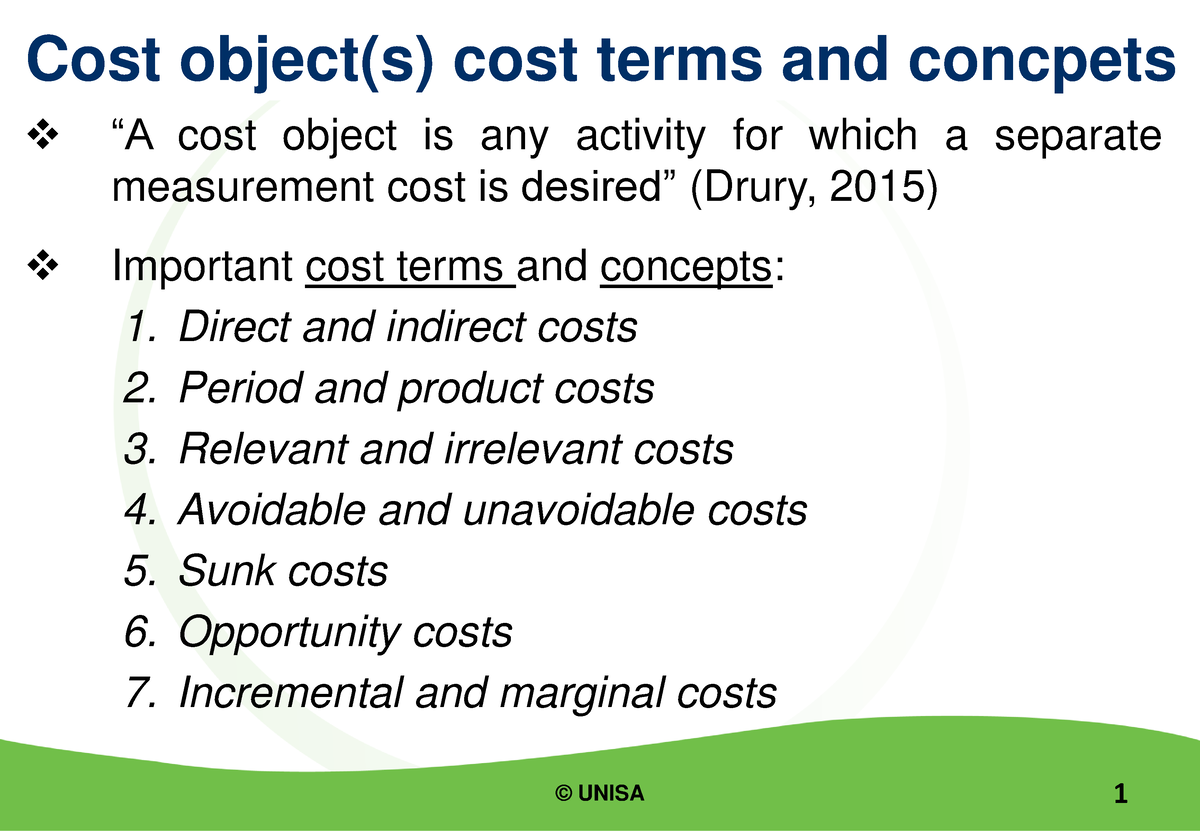

What is the difference between direct costs and indirect costs?

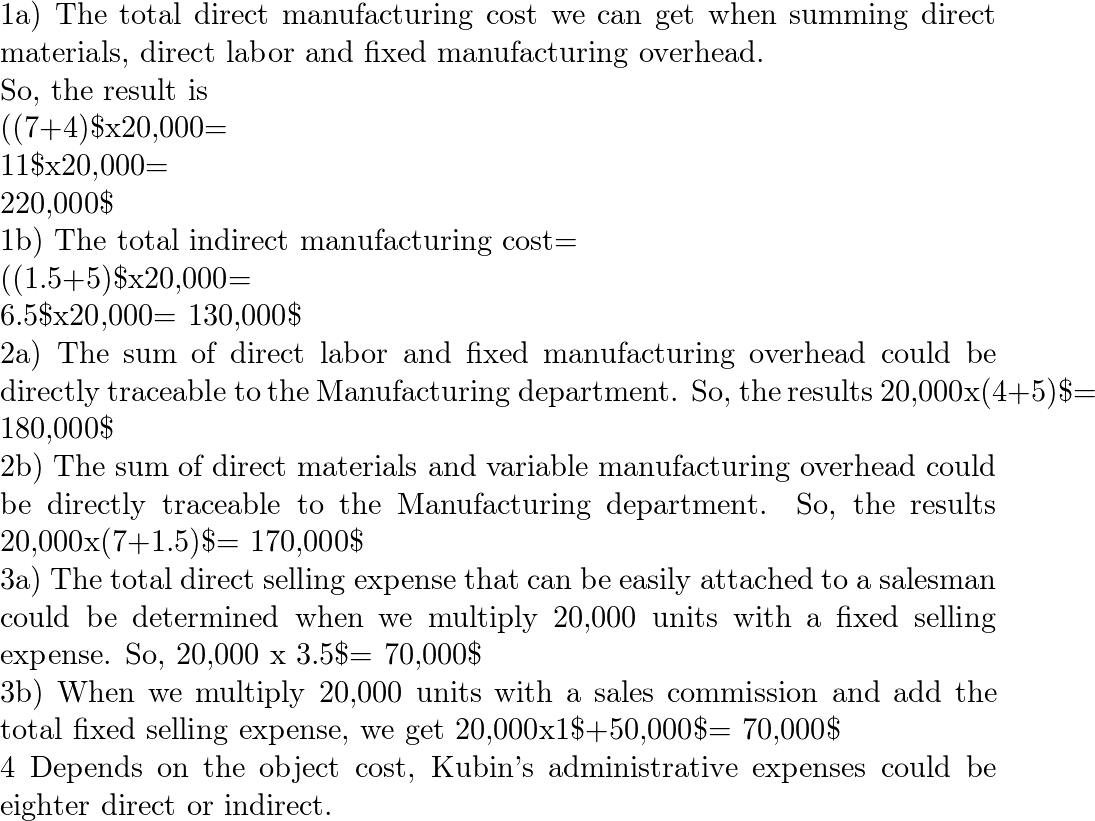

Direct costs need to be properly tracked, measured and valued so they can be correctly attributed directly to a specific cost object, such as a product, service or business unit. Advances in technology have made it easier for businesses to manage their costs and allocate them to cost objects. Cost accounting software can give businesses real-time data and analytics to make informed business decisions. Professional associations, such as the American Institute of Certified Public Accountants (AICPA), offer accounting and finance professionals training and resources.

Operations Managers – Who Typically Assigns Costs to Cost Objects Within an Organization?

Indirect costs (overhead costs) by nature create problems in cost determination and analysis. Direct cost related with a product can be measured with a high degree of accuracy. In the absence of appropriate direct measurement techniques, indirect costs have to be apportioned to different products. For example, suppose in a manufacturing concern there are three separate production departments and a Head Office of the company.

Importance of Defining Cost Objects

By assigning costs to cost objects, businesses can analyze and manage their expenses more effectively, make informed decisions, and improve profitability. Cost objects provide businesses with a way to allocate costs accurately and fairly and help them understand the financial impact of each cost element on their overall operations. Cost objects help businesses control costs by identifying the specific items or activities driving their expenses. By assigning costs to specific cost objects, businesses can track their expenses more accurately and identify areas where they may be overspending. In addition to these stakeholders, other individuals or departments may be involved in the cost assignment process, depending on the specific needs and requirements of the organization.

Ensuring Consistency – Challenges Businesses May Face

But if multiple products are produced in plant A, the manager’s salary is indirect to the specific products. Thus, what is a direct cost for one purpose, may be an indirect cost for another purpose. Examples of indirect costs include factory overhead costs, organization-wide advertising, taxes, and other common or joint costs.

In addition to these types of cost objects, businesses may use many other objects to track costs and make informed decisions. Finally, we will explore techniques for allocating costs to cost objects and discuss how the size of a business can impact its use. By the end of this post, you will have a comprehensive understanding of cost objects and their importance in managing business finances. Direct cost is a relatively simplistic term and can better be understood by doing a comparative analysis with indirect costs so that we may better understand the difference between the two. By also knowing what constitutes an indirect cost, an elimination process can be performed to determine the direct costs.

- The steel and bolts needed for the production of a car or truck would be classified as direct costs.

- It can be challenging to determine which costs should be assigned to which cost objects, mainly if many cost objects are involved or if the costs are not easily attributable to a specific object.

- The most common examples of indirect costs include the following expenditures, assuming they are not specific to a cost object, such as a product, service, department or project.

- Businesses may need to use allocation methods, such as activity-based costing, to allocate indirect costs to cost objects.

For example, a large manufacturing company may have a dedicated cost accounting team responsible for assigning costs to cost objects and analyzing the organization’s financial performance. Cost objects serve as the foundation for accurately measuring and allocating costs within an organization. By clearly defining cost objects, businesses can gain valuable insights into their cost structure and make informed decisions regarding pricing, profitability, and resource allocation. By identifying and assigning costs to cost objects, businesses can gain insights into their operations, identify areas for improvement, and optimize their financial performance.

An indirect cost is a cost that must be allocated to a cost object because it cannot be directly traced. The cost of a receptionist in an accounting firm is hard to assign to individual clients because his or her time is not being tracked by the client. Cost object management can also help businesses to reduce their costs and increase their revenues.

Engaging with these organizations can provide businesses access to the latest updates and best practices in cost object management. One of the key concepts in cost accounting is the use of cost objects, which are specific items, products, or activities to which costs can be attributed. Operations managers are responsible for overseeing the day-to-day operations of the organization. They may assign costs to cost objects related to operational expenses, such as supplies and equipment maintenance.